Frequently Asked Questions

IBF Funding

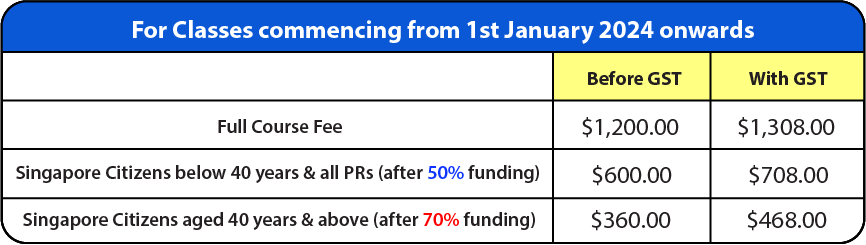

Eligible Singaporeans and PR can obtain up to 70% funding support from The Institute of Banking & Finance (IBF) for our IBF-accredited courses:

The IBF Standards Training Scheme (“IBF-STS”) provides funding for training and assessment programmes accredited under the Skills Framework for Financial Services. For more information on the funding support, please visit: https://www.ibf.org.sg/programmes/Pages/IBF-STS.aspx

NTUC UTAP

Our courses are eligible for Union Training Assistance Programme (UTAP) Funding. NTUC Union members can use UTAP to offset 50% of unfunded course fees (capped at $250 per year).

To check on your NTUC membership status, please call NTUC hotline @ 6213 8008.

This funding support works on a nett fee model.

This means that you will NOT need to pay the full fees, you will only need to pay the remaining course fees after IBF funding.

For Self-Sponsored:

You must be a Singaporean or Singapore Permanent Resident (PR) that is physically based in Singapore. You will only need to pay the course fees minus the funding support.

For Company-Sponsored:

You must be a Singaporean or Singapore Permanent Resident (PR) that is physically based in Singapore and working in an eligible company:

Financial Institutions that are regulated by the Monetary Authority of Singapore (MAS) (either licensed / exempted from licensing)

Fintech companies that are registered with the Singapore Fintech Association

Your company will pay the course fees minus the funding support. For example, if you are eligible for 70% funding support, the company will be paying the nett fees payable for company-sponsored participants.

*This course is NOT claimable under UTAP.*

Some of our courses are eligible for Union Training Assistance Programme (UTAP) Funding.

NTUC Union members can use UTAP to offset 50% of unfunded course fees

The maximum claimable is capped annually at:

- $250 for members below 40 years old

- $500 for members aged 40 and above

For example: If your remaining course fees are $204, you can claim $102 with UTAP.

This claim must be done after completion of the course. Please refer to the UTAP FAQ for more information.

For courses eligible for UTAP funding, you can Apply UTAP via NTUC website at https://skillsupgrade.ntuc.org.sg within 6 months after the course completion. Late application exceeding 6 months from course end date will be rejected.

Terms & Conditions for application of UTAP Funding

- Minimum of 75% attendance for each application and sit for all prescribed examinations

- UTAP application must be submitted within 6 months after course completion

- Please keep a copy of course cert/ Invoice when submitting for UTAP funding

Please refer to this UTAP Step-by-Step Application Guide on how to apply for UTAP funding should you require assistance: https://ntuc.org.sg/wps/wcm/connect/23344da1-84f8-41a8-bece-5802aef6e9b3/UTAP+Step+by+Step+Guide+2018.pdf?MOD=AJPERES

There is no pre-requisites for any of these courses. It is suitable for all professionals.

Payment can be made via Bank Transfer, PayNow, Cheque. We will issue invoices for company sponsored participants to process payment.

You will receive the following after you successfully complete your course

- E-cert for attendance

- Digital open badge to showcase on Linked in profile

*Note: E-Cert will be awarded upon

- 100% attendance

- Passing of assessment (60% passing grade)

You will need to bring along a internet-enabled laptop

At the end of the course on the second day, there will be an assessment.

- 30 minutes

- 15 MCQ (Passing grade: 60%)

- Technical Skills and Competencies: Sustainable Finance - Sustainability Reporting

- Proficiency level: 3

- CPD hours: 13 hours (only applicable for company-sponsored learners)