What is Corporate Training?

Corporate training refers to educational courses for employees, usually provided free of charge. It includes diverse topics tailored to individuals across different companies and industries, promoting professional growth through skill enhancement and certification.

CORPORATE TRAINING COURSES IN SINGAPORE

WHY CHOOSE AVENTIS?

Aventis Learning Group (ALG) is the corporate training arm of Aventis Graduate School (AGS), a private educational institution committed to nurturing professional development and continuing education in leading organizations.

As Asia’s foremost multi-award-winning corporate training solutions provider, ALG is entirely devoted to offering stimulating, cutting-edge, and practical professional courses and effective training solutions that meet the learning and developmental business goals of Managers, Executives (PMEs) and Professionals.

Since our establishment in 2008, we have had a successful and impressive track record. We have conducted approximately over 600 professional courses, and certification programs annually. Here at ALG, we pride ourselves in our wide selection of high-quality courses - our corporate training courses focus on niche areas such as short law courses, finance training courses, leadership, corporate sustainability, data analytics, data science, artificial intelligence (AI), self awareness and personal development, digital transformation, and more to allow our learners to keep up with evolving industry trends.

Successful Track Record of Over a Decade Since 2008

Multi-Award-Winning Corporate Training Solutions Provider

One-Stop Corporate Training Solutions Provider

OUR UPCOMING POPULAR COURSES

EXPLORE OUR IN-DEMAND CATEGORIES

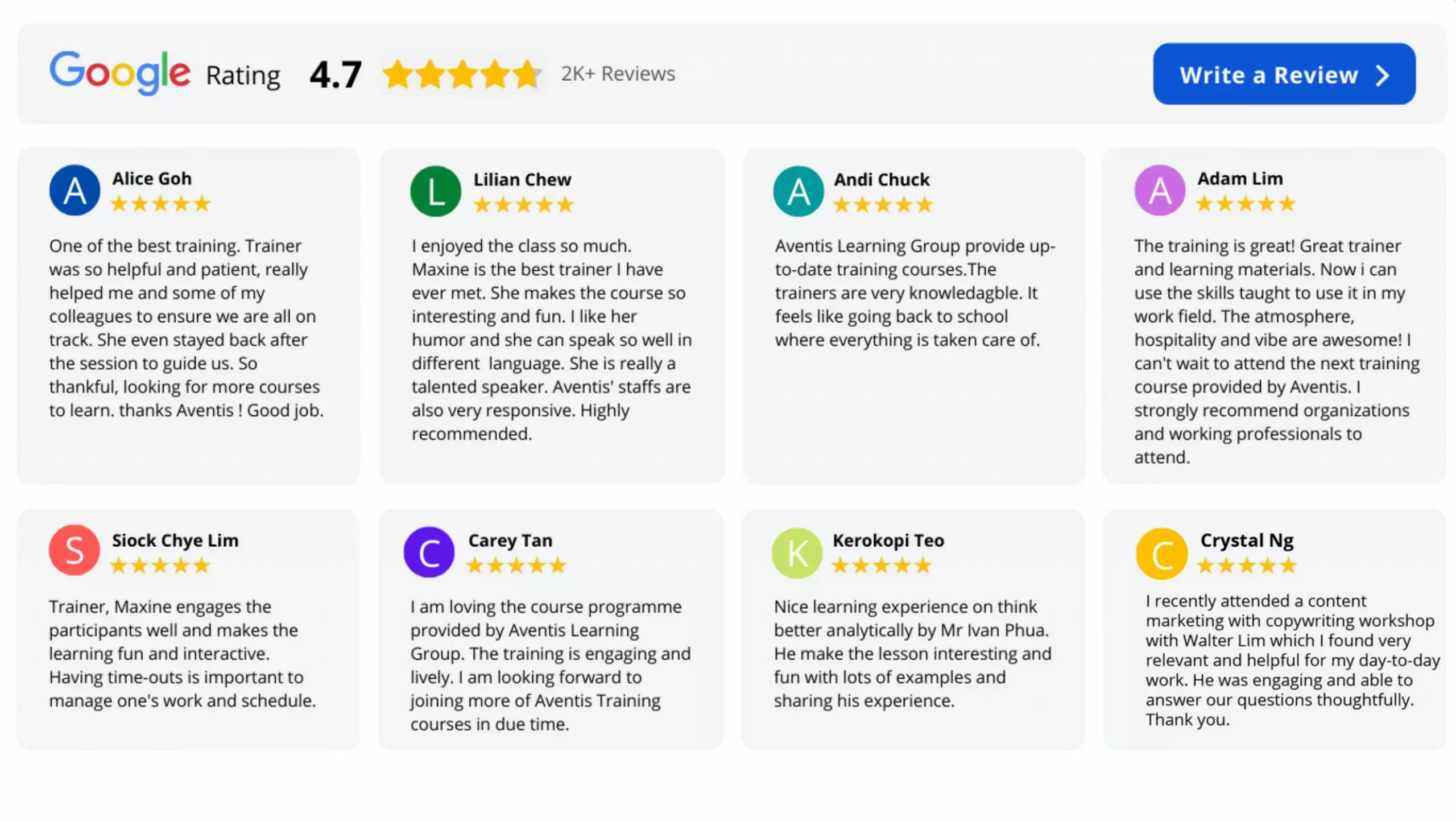

WATCH OUR VIDEO TESTIMONIALS

OUR SATISFIED CLIENTS

Over the years, Aventis has successfully partnered with numerous organizations, from government agencies, private organizations and NGOs to assist them in enhancing their management.

ONE-STOP CORP TRAINING AND DEVELOPMENT SOLUTIONS

We are honoured to be recognised by the prestigious Training, Education, and Development (T.E.D.) Awards as the Best Corporate Training Provider in 2018 for our “Personal Effectiveness & Productivity” and “Communications” courses. In the same year, we were also awarded the Gold Standard Service Provider award for our “Finance Management” and “Senior Management & Leadership” training courses by T.E.D. Jobs Central.

Moreover, we are delighted to be recognised as the Corporate Training Course of the Year in Singapore and crowned the winner of the Prestige Award in 2021/2022. Aventis Learning Group is also a “Great Place to Work®” certified company.

As your one-stop corporate training solutions provider in Singapore, we provide numerous modalities of learning to fit diverse profiles of working professionals, including classroom learning, virtual learning through Zoom, and asynchronous self-paced e-learning courses. We also provide tailored training solutions for businesses, including courseware creation, in-house training, blended learning, and Training Needs Analysis (TNA).

No matter if you are looking for finance training courses, digital marketing, cyber security or even short law courses in Singapore, we guarantee that there is something for everyone. Our modules not only offer a solid foundation in key skills but also provide an interactive environment for hands-on practice and refinement. Develop new skills and upgrade your knowledge with our professional courses today.